Posted : 26/09/2025

5 minute read

Treasury Visibility: Real‑Time AP Tracking for Smarter Decision Making

1. Introduction: Why Visibility Matters for Treasury Teams

Treasury leaders are under constant pressure to manage liquidity, mitigate risk, and ensure working capital is used optimally. Yet many struggle because of limited insight into Accounts Payable (AP) workflows. Without real‑time tracking, AP becomes opaque, leading to surprises in cash flow, delayed payments, and poor forecasting.

FinTrend’s FinHub offers real‑time visibility into AP flows, delivering the clarity treasury teams need to make better decisions, anticipate cash needs, and respond faster.

2. The Visibility Gap: Common Pain Points in AP for Treasury

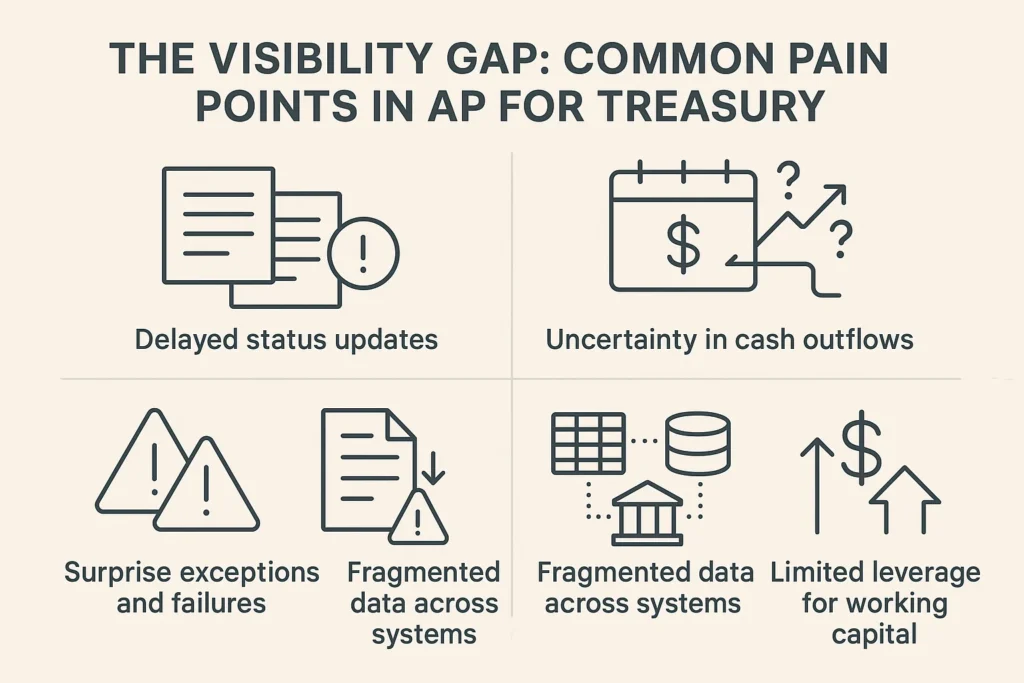

Here are typical challenges treasury teams face due to a lack of AP visibility:

- Delayed status updates

Payments stuck in approvals, in transit, or failed get lost in emails or spreadsheets. The treasury team cannot see where exactly a payment is in the chain. - Uncertainty in cash outflows

Without clarity on when AP payments will actually settle, forecasting becomes speculative rather than dependable. - Surprise exceptions and failures

Failed payments or rejected invoices may only be discovered late, increasing risk, rework, and vendor dissatisfaction. - Fragmented data across systems

AP information is scattered across ERP, banks, and spreadsheets with delays in syncing, inconsistent formats, and reconciliation gaps. - Limited leverage for working capital

When the treasury cannot see pending liabilities in real time, opportunities for cash management (e.g., short‑term investments, temporary borrowing) are missed.

3. How FinHub Delivers Real‑Time AP Tracking

FinHub is designed to fill the visibility gap. Below are its key features and how they help treasury teams:

Real‑Time Dashboard & Monitoring : FinHub provides a centralized dashboard that shows cash flow, pending AP transactions, and payment failures live. Treasury can drill into transaction history, identify bottlenecks, and immediately see the status of each payment. fintrendinc.com

Transaction Drill‑Down & Traceability : Each AP transaction has a traceable lifecycle: initiation, approval, routing, settlement, or exception. Treasury can investigate any transaction’s journey, check timestamps, and detect delays.

Alerts & Exception Handling : FinHub can trigger alerts on failed payments, delays, or anomalies. This helps the treasury act proactively rather than discovering issues post‑fact.

Integration with ERP and Bank Systems : AP data flows from ERP systems, banking APIs, and payment partners into FinHub’s engine. This ensures consistency, reduces latency, and keeps all systems in sync.

Automated Reconciliation & Matching : Once a payment is confirmed, FinHub helps reconcile it automatically against the ledger and bank statements. This removes manual matching and ensures that the AP status is updated instantly in Treasury views.

4. Benefits of Real‑Time AP Visibility for Treasury

By gaining visibility into AP flows, treasury teams unlock multiple advantages:

- Improved liquidity forecasting

With clarity over when payables will clear, treasury can model cash needs more precisely and avoid surprises. - Faster decision-making

Treasury can make funding, borrowing, or investment decisions with up‑to‑the‑minute data rather than stale reports. - Reduced risk and exceptions

Early detection of failures or delays means resolving issues before they cascade into vendor disputes or compliance problems. - Stronger operational control

Visibility ensures that the treasury is not operating in the dark. It becomes a command center overseeing payments end-to-end. - Better vendor relations

Payments processed timely, consistently, and transparently strengthen trust with suppliers.

5. Use Case: How a Treasury Team Uses AP Visibility in FinHub

Scenario

A company’s treasury needs to approve and fund a large batch of supplier payments by the quarter’s end. They must ensure payments are settled on time, avoid cash shortfalls, and handle any exceptions quickly.

With FinHub Visibility

- Treasury reviews the dashboard to see which invoices are approved and queued for payment.

- They simulate projected cash outflow over the next 48 hours to ensure funds are sufficient.

- Any payment that fails or is delayed triggers an alert. Treasury investigates instantly via the transaction trace.

- Reconciliation happens automatically as payments confirm, so ledger and treasury systems stay current.

- Because status is visible, liquidity choices (invest or borrow) are made with confidence.

6. Structuring the Blog for Publication

- Introduction / Hook: Lead with a pain point: “Treasury made a wrong cash forecast because AP delays were hidden.”

- Problem Section: Lay out the visibility challenges.

- FinHub Solution Section: Explain features that deliver real‑time tracking and visibility.

- Benefit Section: Show how treasury teams benefit.

- Introduction / Hook: Lead with a pain point: “Treasury made a wrong cash forecast because AP delays were hidden.”