Posted : 26/08/2025

5 minute read

Streamlining Corporate Account Payable: How Treasury Teams Can Benefit from FinHub

Corporate treasury teams manage critical cash functions. Yet, outdated AP processes slow them down, erode visibility, and risk compliance. FinHub, by consolidating workflows, automating approvals, embedding controls, and delivering real-time insights, transforms treasury operations into strategic, efficient hubs.

1. The Cost of Friction in Treasury Payables

Corporate treasury teams juggle real-time cash management, risk mitigation, compliance, and accurate financial planning. Accounts Payable (AP) often becomes a bottleneck manual approvals, scattered systems, and delayed reconciliations restrict liquidity and transparency. Enter FinHub, a centralized, API-first payment orchestration platform that transforms how treasury teams manage payables.

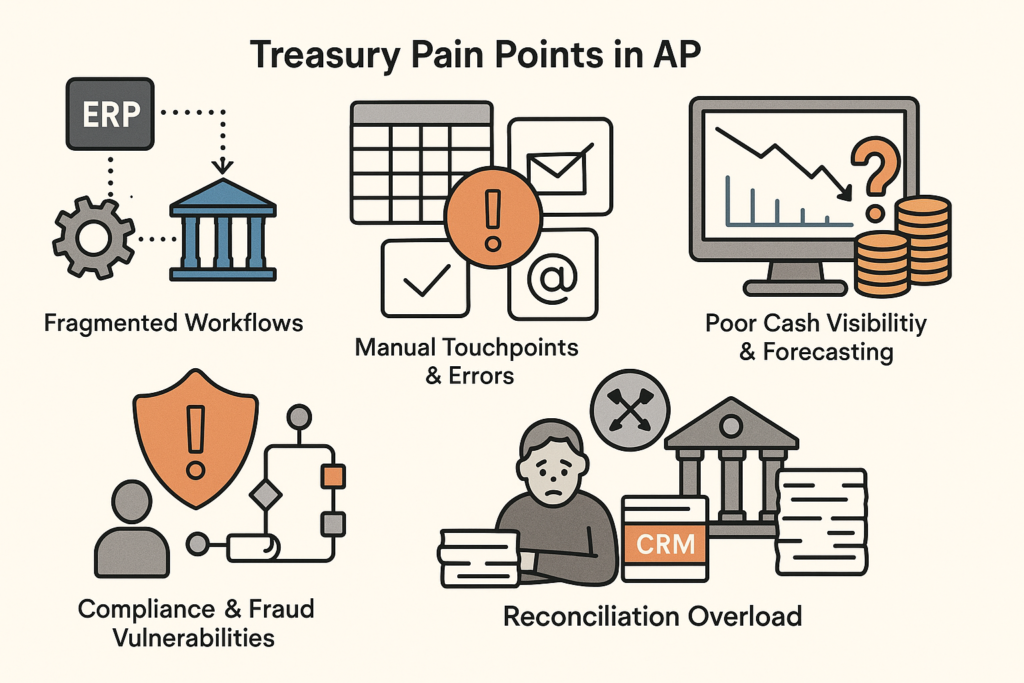

2. Key Treasury Pain Points in AP Processing

- Fragmented Workflows : Multiple tools and silos, from ERP to bank portals, lead to inefficiencies, data mismatches, and limited visibility into payment status.

- Manual Touchpoints & Errors : Spreadsheets, email approvals, and manual uploads are slow and error-prone, delaying payment cycles and undermining accuracy.

- Poor Cash Visibility & Forecasting : With AP unpredictability, forecasting becomes reactive. Treasury teams strain to model liquidity accurately while working capital stalls.

- Compliance & Fraud Vulnerabilities : In absence of systematic controls, such as vendor validation, multi-level approvals, and audit trails, audit risk and fraudulent exposures escalate.

- Reconciliation Overload : Delayed reconciliation with banks and ledgers impedes month-end closing and obscures true cash positions.

3. FinHub to the Rescue: FinTrend’s Treasury Power Tool

- Centralized Payment Orchestration : FinHub is a cloud-native platform that brings together all payment methods and workflows: ACH, wire, cards, wallets, into one interface. It orchestrates across banking partners, ERPs, and treasury systems. FinHub: Your Centralized Payment Solution.

- Automated, End-to-End AP Workflows : FinHub automates steps from invoice approvals to payment execution and reconciliation. This eliminates manual data entry, reduces delays, and sharpens operational efficiency. fintrendinc.com

- Real-Time Visibility & Control : Treasury teams gain insight into payment statuses, from initiation to settlement, in real time, empowering accurate liquidity forecasting and dynamic cash decisions. Finhub

- Embedded Compliance & Approval Logic : FinHub allows configuration of custom approval hierarchies and compliance checkpoints. It ensures controls are enforced systematically, lowering regulatory and fraud risk.

- Seamless Reconciliation & Reporting : By tying payment execution directly into reporting and ledger systems, FinHub streamlines reconciliation and accelerates close cycles, reducing risk and freeing treasury capacity.

4. Benefit Matrix: The FinHub Advantage for Treasury-Driven AP

| Treasury Challenge | FinHub’s Capability | Resulting Benefit |

| Disjointed systems | APIs integrate ERP, banking, and finance stacks | Synchronized data flow & single dashboard view |

| Slow, manual processing | Automation of approvals, payments, reconciliation | Fast, accurate AP cycles |

| Fragmented cash forecasting | Real-time tracking and dashboards | Proactive liquidity management |

| Compliance risk | Embedded workflows and audit trail | Tightened controls, reduced fraud exposure |

| Month-end reconciliation pain | Integrated reconciliations and reporting | Efficient closures, clear financial view |

5. Practical Scenarios: FinHub in Treasury Operations

- Dynamic Approval Routing: Tiered approval based on amount, vendor, or geography-accelerating low-risk payments, flagging high-value ones for review.

- Smart Liquidity Forecasting: With visibility into pending payables and settlement timelines, treasury teams can proactively manage cash buffers and funding needs.

- Audit-Ready Reporting: FinHub produces detailed logs and dashboards, simplifying audits, policy reviews, and board reporting.

6. Why FinHub Stands Out

- Unified Control Layer: Orchestrates payments across channels via one platform. No more toggling between ERP, banks, and tools.

Finhub - Automation + Security: Payments and processes run faster, but remain controlled and compliant. No tradeoff.

- Built for Scale: Whether handling rising AP volumes or entering new payment corridors, FinHub expands effortlessly thanks to its modular, API-first architecture.

- Real-Time Cash Insight: No more guesswork. Always know what’s pending, what’s settled, and your true liquidity outlook.