Posted : 19/06/2025

5 minute read

FinHub: Your Centralized Payment Solution

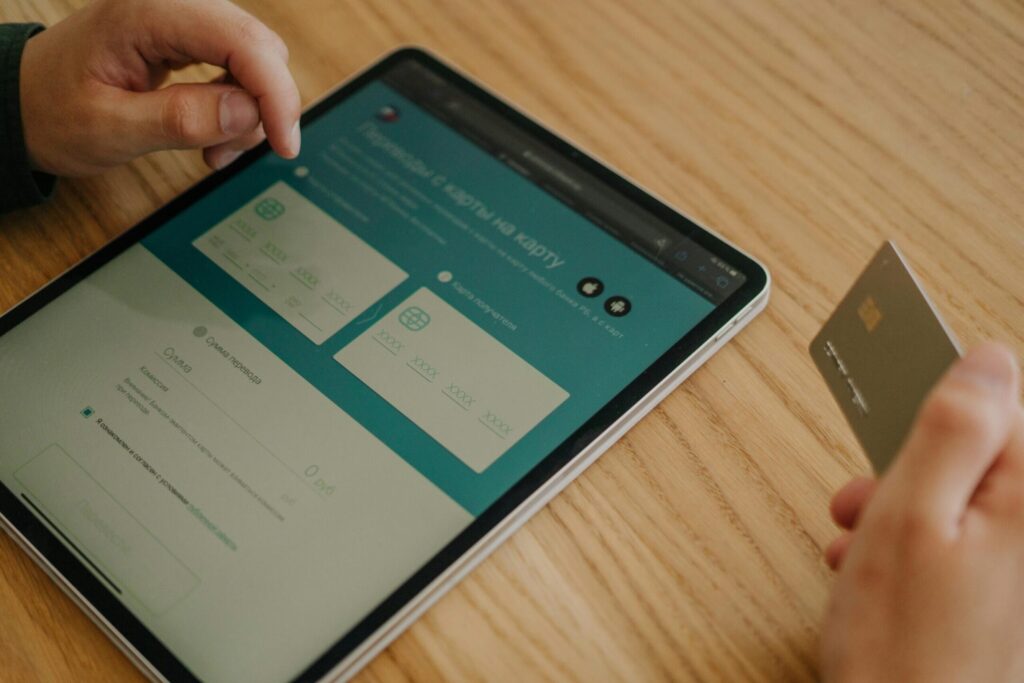

In today’s fast-paced digital economy, businesses are juggling multiple payment methods, platforms, partners, and currencies. This fragmented financial landscape creates operational inefficiencies, increases compliance risks, and impedes real-time decision-making.

Enter FinHub—FinTrend’s centralized payment solution designed to bring all your payment operations under one intelligent, secure, and scalable platform. Whether you’re a startup scaling quickly or an enterprise optimizing your payment infrastructure, FinHub is your unified command center for all things payments.

What Is FinHub?

FinHub is a cloud-native, API-driven payment orchestration platform developed by FinTrend. It empowers businesses to:

- Consolidate all payment operations across various channels.

- Automate payment workflows, including invoicing, reconciliation, and disbursements.

- Integrate seamlessly with banks, wallets, card networks, and fintech partners.

- Monitor transactions and analytics in real-time.

- Ensure compliance with ISO 20022, SWIFT standards, and global regulations.

By acting as a single integration layer between your systems and the financial world, FinHub eliminates the need for multiple payment providers or fragmented tools.;

Why Centralized Payments Matter

Here’s why companies are moving toward centralized payment solutions like FinHub:

Operational Efficiency

Instead of managing different systems for bank transfers, card payments, wallets, and international remittances, FinHub brings them under one dashboard. This means less context switching, lower costs, and streamlined operations.

Scalability

As your business grows, so does the complexity of your financial flows. FinHub’s flexible APIs and modular structure ensure you can scale without rearchitecting your payment stack.

Faster Reconciliation

With automated ledgering and intelligent matching, FinHub reduces reconciliation time from hours to minutes, helping your finance team close books faster and with more confidence.

Regulatory Compliance

FinHub is built with compliance in mind—supporting SWIFT messaging, ISO 20022 formats, and KYC/AML checks as part of its transaction flows. You stay ahead of audits and avoid regulatory penalties.

Key Features of FinHub

Multi-Channel Payment Orchestration

Connect with multiple banks, gateways, wallets, and crypto providers through one integration. Route payments smartly based on cost, speed, or location.

Invoice & Billing Automation

Automatically generate invoices, handle tax rules, and apply discounts or penalties based on business logic. Sync this data with your ERP or accounting software.

Bulk Disbursements

Send salary payments, vendor payouts, or loan disbursements in bulk—instantly and securely—while tracking each transaction’s status.

Real-Time Dashboard

Get complete visibility into cash flow, pending transactions, and payment failures. Drill down into transaction histories and export reports for audits.

Enterprise-Grade Security

FinHub is PCI DSS compliant, uses end-to-end encryption, and supports 2FA and role-based access control. Your financial data stays safe and private.

FinHub in Action: Use Cases

1. Lending & Loan Management

A fintech startup uses FinHub to disburse personal loans to customers’ bank accounts and track EMI payments with real-time reminders.

2. Marketplace Vendor Payouts

An e-commerce company pays hundreds of vendors weekly using FinHub’s bulk disbursement API, reducing manual errors and delays.

3. Utility & Subscription Billing

A utility provider leverages FinHub’s recurring billing system to auto-charge customers monthly and handle failed payment retries automatically.

Why Choose FinHub by FinTrend?

FinTrend is at the forefront of modern financial infrastructure. With FinHub, we bring:

- Years of domain experience in payments and financial messaging.

- Secure, scalable, and compliant APIs for rapid integration.

- Deep analytics to turn your financial operations into a strategic asset.

Final Thoughts

The future of business finance is not scattered—it’s centralized, automated, and intelligent. With FinHub, FinTrend empowers businesses to modernize their financial operations, improve cash flow visibility, and deliver seamless payment experiences to customers and partners alike.

Start your journey to smarter payments. Connect with FinHub today.