Posted : 11/09/2025

5 minute read

From Manual to Automated: Transforming Treasury AP with FinTrend’s FinHub

1. Introduction: The Burden of Manual AP in Treasury

Treasury teams are the backbone of an organization’s financial stability, managing cash flow, liquidity, risk, and compliance. Yet, Accounts Payable (AP) often remains mired in outdated, labor-intensive processes: invoice approvals via email, manual data re-entry, fragmented ERP uploads, and delayed reconciliations. These workflows hinder efficiency, reduce accuracy, and obscure visibility.

With the evolving corporate treasury landscape demanding speed, control, and transparency, FinTrend’s FinHub offers a powerful solution to shift from manual chaos to automated clarity.

2. Manual AP Workflows: What’s Holding Treasury Back

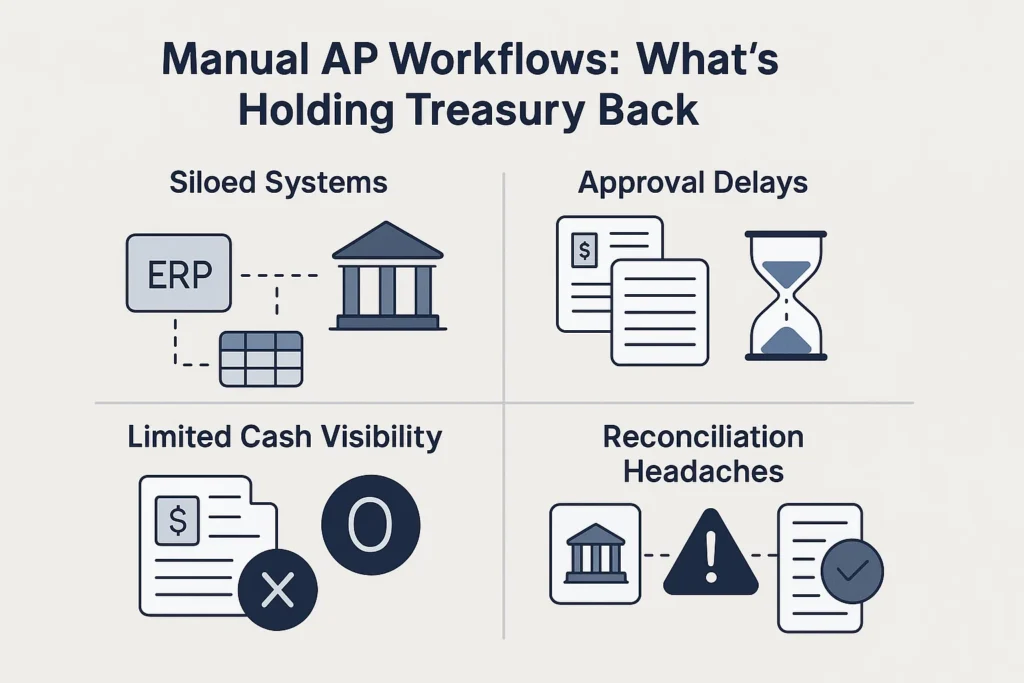

Here’s how traditional AP workflows slow treasury operations:

- Siloed systems: AP data lives across disconnected tools like ERPs, bank portals, and spreadsheets, requiring manual coordination and prone to mismatch.

- Approval delays: Routing invoices manually, often over email or paper, slows payment cycles and risks missed deadlines.

- Limited cash visibility: Untracked payments create blind spots, making forecasting and liquidity planning reactive instead of strategic.

- Reconciliation headaches: Matching bank statements, invoices, and ledger entries is time-consuming, especially during month-end closing.

- Compliance risk: Without digital audit trails, organizations face increased exposure to errors, fraud, and regulatory gaps.

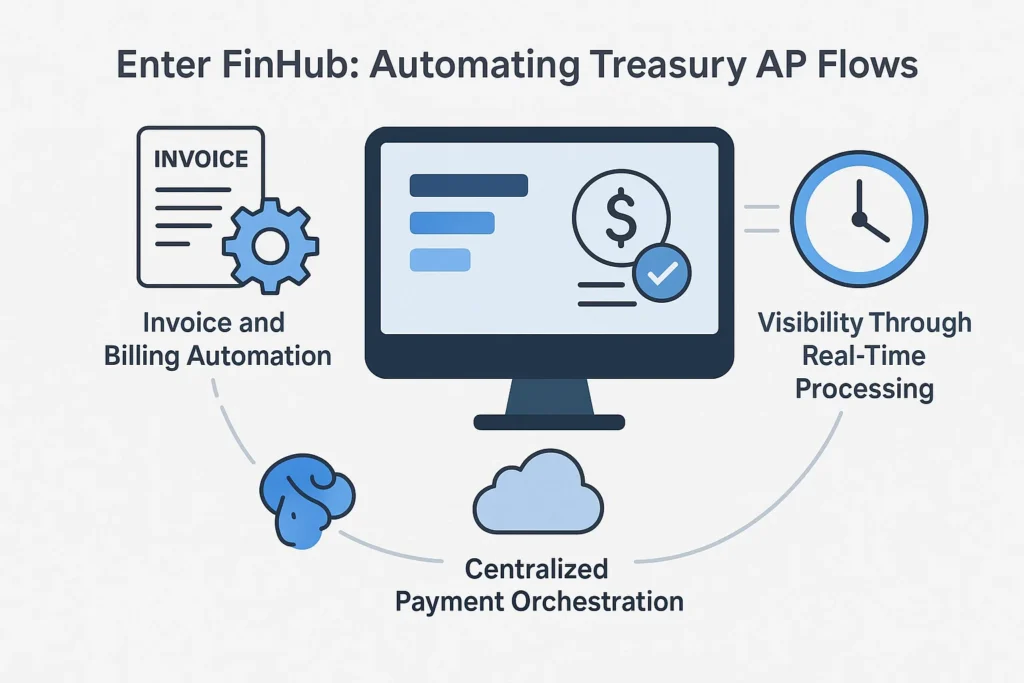

3. Enter FinHub: Automating Treasury AP Flows

1. Invoice and Billing Automation: FinHub enables automated generation of invoices, applies tax logic, discounts, penalties, and synchronizes billing data effectively, eliminating manual invoice workflows.

2. Centralized Payment Orchestration : As a cloud-native, API-driven platform, FinHub centralizes workflows across different payment channels such as ACH, wire, cards, and wallets. It integrates seamlessly with ERPs and banking partners, bringing all AP processes into one dashboard.

3. Visibility Through Real-Time Processing: FinHub delivers real-time processing and transparency of AP flows. From initiation to settlement, treasury teams can monitor payment progress live, enhancing forecasting and reducing uncertainty.

4. From Manual to Automated: Benefits at Each Stage

AP Challenge (Manual Era) | FinHub’s Automated Solution | Treasury Benefit |

Fragmented invoice workflows | Invoice automation with tax logic and billing sync | Reduces errors and speeds processing |

Disconnected payment systems | Centralized orchestration across multiple payment channels | Streamlines operations and improves scale |

Opaque cash movement | Real-time visibility into payment lifecycle | Improves forecasting and liquidity control |

Bank and ledger reconciliation delays | API integration for reconciling payments and books | Faster closes with fewer mismatches |

Risky, manual audit trails | Digital process flows with logs and audit trails | Better compliance posture and risk management |

5. A Transformation Workflow: FinHub in Action

Example Scenario – Supplier Payment Batch

- Invoice intake: FinHub automatically generates or ingests supplier invoices with embedded business logic including taxes, discounts, and due dates.

- Automated validation and routing: Based on predefined rules such as amount, cost center, or region, invoices are routed to the correct approvers.

- API-powered payment execution: Once approved, FinHub initiates payment via APIs to banks or financial partners without manual file uploads.

- Live tracking and alerts: Treasury sees payment statuses in real time such as pending, in progress, and settled, streamlining liquidity oversight.

- Automated reconciliation: Payments are matched automatically with ledger entries once confirmed by the bank, avoiding manual logs and saving close time.

- Audit-ready logs: Every step from invoice to approval to payment is logged digitally for compliance and internal review.

6. Why FinHub Excels in AP Automation for Treasury

- End-to-End Workflow: From billing to reconciliation, all AP stages are automated and integrated.

- API-First and Cloud-Native: Easily scales with business growth, integrates across systems, and remains resilient.

- Real-Time Cash Intelligence: Live data empowers proactive treasury management and liquidity control.

- Compliance Embedded: Auditable rules and logs reduce risk and support regulatory needs.

7. Organizational Impact: Efficiency, Strategy, and Control

A treasury empowered with FinHub:

- Executes payments faster, eliminating email approvals and manual uploads

- Strengthens forecasting accuracy using live insights into AP flows

- Accelerates closing processes with automated reconciliation

- Improves governance with transparent audit trails

- Elevates the treasury’s strategic role from operational support to financial leadership